People usually want to have their own homes because of various reasons — one being the pride of home ownership. However, every time may not be opportune for buying a home. Currently, coronavirus has disrupted almost every industry, including real estate. Keeping that in view, is this the right time to buy a home or invest in a piece of property?

Industry experts believe a volatile stock market and underperforming mutual funds have raised the need for a stable asset class that can give better returns. And what a better option than buying or investing money in a home? Moreover, residential real estate is at its best now, with lower interest rates and a buyer’s market. No wonder, several surveys conducted by property consultants recently have revealed that housing enquiries have rebounded to 50% of pre-COVID-19 levels in the top cities and a majority of homebuyers are willing to return to the market in the coming 3 to 6 months.

As per an ANAROCK report, ready-to-move in homes are currently dominating buyer preference, and homes priced between Rs 40 lakh and Rs 1.25 crore are in the highest demand. Also, almost 80% of housing deals during the pandemic have been struck by end-users.

Here we take a look at 7 reasons why this may be a good time to buy one’s home:

1. Supply side factors positively influencing the market

Compared to past events when the world has faced a crisis of such magnitude, like the dotcom crash, or the oil crisis, or the global financial crisis (GFC) of 2008, the economic health and financial position of the residential real estate market is relatively better currently.

“The reason I say this is because, during the GFC the residential market valuations were overheated, which is more realistic now. Unlike 2008, the nature of the market has also changed. While in the past it was a seller’s market, now it is a buyer’s market. We have also seen significant reduction in home loan rates. They are much lower than the rates in 2008-09. At the same time, our banks are in a better position to lend now compared to the past. We are also in a very benevolent tax regime with tax benefits for both developers and end-users. The speculative fear is much less compared to the market scenario during 2008 and 2009,” says Siva Krishnan, MD-Residential Services, JLL India.

There is also a case for positive portfolio rejig. While in 2008-2009, developers had spread themselves thin across varied portfolios, such as senior living, vacation homes, etc, currently, project portfolio consists of relevant projects targeting budget-friendly end-users mainly in the affordable and mid-segment housing.

2. Home loan interest rates at record low

The RBI has reduced the repo rate on multiple occasions in the recent past, resulting in home loan interest rates plummeting to sub-7% levels. Now, from that perspective, aspiring homebuyers should not try to let go off these record-low rates if they have the necessary margin money. In fact, a year ago when home loans were in the range of 8-9%, a Rs 50 lakh loan for 20 years at 8.5% p.a. would have meant an EMI of Rs 43,391. But you now might get the same loan at 7%, which would mean your EMIs could go down by Rs 4626 to Rs 38,765, resulting in savings of over Rs 11 lakh in total interest payable.

However, “aspiring homebuyers must understand that the repo-linked home loans come with a customer risk spread and the lowest home loan rates are offered only to those applicants with credit scores over 750-800. So, they must check their credit scores before applying for the loan, and if they find it to be lower than 750, they should take steps to improve it to not just to get the best loan offers, but also to enjoy low EMIs throughout the loan tenure,” says Adhil Shetty, CEO, BankBazaar.com.

3. Better Government support: Faster recovery in cities

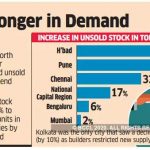

The government has been prompt in announcing fiscal and other stimulus packages, unlike in the past. People are aware that the dependency on global funds for the residential sector is limited. Residential real estate demand is mainly local in nature. IT/ITES has not been affected significantly and this is quite evident in the recovery that’s being witnessed currently. Bengaluru followed by Pune, Hyderabad and Chennai are actually doing better compared to other cities. As noted above, we are in the midst of a very benevolent interest rate regime with the repo rate being the lowest compared to the 2008 levels. So are the other benchmark rates.

4. Demand side enablers

During the previous crisis scenarios, the property market was overheated, resulting from higher valuations, declining Loan to Value ratio (LTV) and unfavorable interest rates. However, the scenario is currently more favorable for buyers with higher LTVs, lower valuation and cheaper credit availability. “The need and urge to own property is at an all-time high post the spread of Covid-19. The impact of price benefit and lower home loan rates is actually enabling customers to buy property. Also, the house hunt, especially with end users, is initiated 6-8 months prior to the actual buy date and the current softening of prices and housing loan rates is actually pushing the pent-up demand in the system,” informs Krishnan.

5. Real estate a stable asset

The volatility and unpredictability of the stock market has not just eroded wealth, but also the confidence of investors. This has also helped real estate gain a positive traction as a stable asset class. The luxury market may be hit initially as luxury homebuyers typically have a higher stake in the stock market. Rental yields are expected to improve with rationalization in prices if aspects such as job security and gradual economic revival are assumed to remain favorable. It will have a favorable impact on improving the buyer sentiment.

Thus, industry experts believe, the above factors should help in improving buyer sentiment, thereby translating into gradual upward movement in sales.

6. Property available at reasonable prices

Another good reason to buy one’s dream home in current times is the availability of housing units at reasonable prices.

“In fact, it is probably the best of times for end-users to buy property because prices are as low as they will get and some developers are willing to negotiate further. End-users have a wide selection of options to choose from in almost all locations and budget bandwidths, and can buy ready-to-move in properties at prices which were previously seen only in under-construction projects,” says Anuj Puri, Chairman, ANAROCK Property Consultants.

7. Better Deals

The kinds of offers and realty deals which homebuyers are getting now are usually seen only during the brief festive period. It is true that in the present scenario, owing to distress across almost all sectors of economy and impending uncertainty of ‘what lies ahead’, buying decisions of all non-essentials, especially for salaried middle class, will be deferred. This surely affects demand for residential assets, especially in the affordable & mid segments, where affordability is seriously on tight lines.

However, “better deals always come in such scenarios. Good projects may not offer direct lucrative discounts. However, buyers might get some composite sweetened deals in terms of complementary car parking or waiver of charges or staggered easy payment plans. This is an ideal buyers’ market, wherein lucrative deals can be availed and negotiated in the primary market. In addition, lower interest rates on home loan add to the lucrativeness of the “opportunity to buy now” as the interest rates are at a level from where it is only going to head northwards,” says Ashutosh Kashyap, Associate Director-Valuation and Advisory Services at Colliers International India.

Conclusion

Thus, because of the above-mentioned reasons, it surely seems to be an ideal time to buy a piece of property. However, it may not be an optimal time to buy property for investment if the view is on capital appreciation, unless one has a really generous investment horizon. “An investment property can nevertheless generate steady rental income, but this aspect needs to be thoroughly researched before making a purchase,” advises Puri.

(Source: Financial Express)