The luxury housing segment, where investors used to drive demand, is in the doldrums because of uncertainties in the market with the real estate sector going through a downturn, and is now hinging largely on sales to end users. Around Rs 1.59 lakh crore worth of luxury housing stocks remained unsold at the end of 2019, contributing nearly 34% to the total value of all unsold homes across top residential markets.

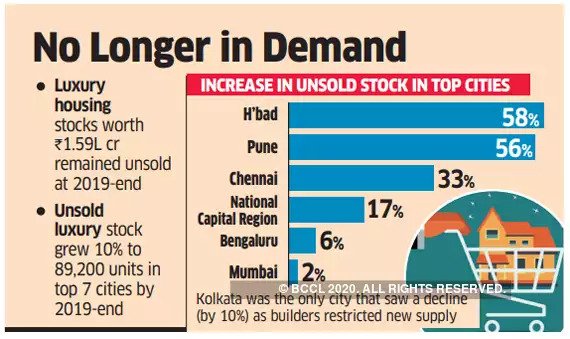

“Even after three years of demonetisation, despite having the lowest share of overall unsold stock in the top seven cities, it remains the worst-performing of all budget categories,” Anarock Property Consultants chairman Anuj Puri said. Unsold luxury stock increased 10% from a year earlier in the top seven cities by the end of 2019.

There were 89,200 units of unsold luxury stock (homes priced Rs 1.5 crore or more) by end-2019 as against 81,290 units in 2018, Anarock Research said in a report.

“Homebuyers have become price sensitive. There has been a reduction in ticket sizes by around 30% to 50% and apartment sizes by 10%,” Vista Spaces joint managing director Raghuveer Veeramachaneni said.

The company that focussed on city-centric luxury homes is now reworking some of those projects. The highest increase in stocks was seen in Hyderabad and Pune, by 58% and 56%, respectively. These cities were followed by Chennai at 33% and the National Capital Region at 17%. Luxury home stocks rose 6% in Bengaluru and 2% in Mumbai, said the report. Kolkata was the only city that saw a decline in stocks — by 10% — as builders restricted new supply.

Luxury developers have severely curtailed the supply pipeline, primarily due to the absence of investors in this segment. “We are focusing on mid-income homes as demand is high in that segment. We do not want to do anymore luxury homes and are only selling unsold stocks,” said the CEO of a Bengaluru-based, listed company, who did not wish to be named.

For the housing sector, 2019 was a non-event year in terms of sales growth and investor interest. Sentiment remained subdued, sustaining almost solely on end-user activity focused on ready-to-move-in or almost-complete homes.

Branded developers, however, gained ground, with some listed companies performing exceptionally well on sales and revenue growth.

(Source: Economic Times)