For most people the main purpose of buying real estate as an investment is to make profit. However, there can be instances where you might buy a property without considering all factors involved and without calculating the full cost. And when you do this, you may not get the returns you wanted, or worse, make a loss.

To make sure you don’t make a loss while selling the property or even end up being saddled with an illiquid investment, here are five mistakes to avoid while investing in real estate.

1. Not knowing your credit score

If you apply for a loan for your property purchase, your lender is going to investigate your credit history. Adhil Shetty, CEO, BankBazaar.com said, “Any problems in your credit history may lead to a loan application being rejected or being approved but with a high rate of interest. The best loan offers are typically reserved for borrowers who have a credit score of 750 or more. They get the benefit of the lowest rates.” Therefore, before you apply for a loan, take a few minutes to check your credit score online.

2. Not weighing full cost of real estate investment

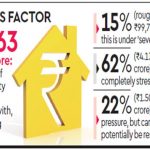

When you invest in real estate, you must weigh the full cost of investment. For instance, on a base price of Rs 100, your additional charges of homeownership such as GST, registration, stamp duty, brokerage, furnishing, costs of borrowing etc. can easily pull the whole bill to Rs 120 or Rs 130.

Shetty said, “In an under-construction property, you will need to pay GST at 5 per cent, and 5-7 per cent on registration and stamp duty depending on your state norms. Furnishing the house maybe another 5 per cent. You may be looking at 15 per cent of your base price easily. If the cost is Rs 1 crore, you will need to spend Rs 15 lakh on these additional costs.”Shetty further explained: Assuming a base price of Rs 100 for a resale property in Delhi, the additional charges may be Rs 7 for stamp duty and registration. Apart from this, you may pay a charge for costs of borrowing (processing fees and MOD charges), which may be upwards of Rs 0.10, or brokerage of up to Rs 1. Assuming the house to be unfurnished, one can also add Rs 3-5 in most cases for furnishing costs, but this is a matter of taste and budget, so costs could vary wildly from one case to another.

Besides, a bank will typically fund 75 per cent in a high-value loan or up to 90 per cent in a low-value loan. The rest needs to be provided by you. Therefore, in most cases, you are going to need at least 20-25 per cent of the budget ready as cash in hand, says Shetty.

3. Impulse buying

Santhosh Kumar, Vice Chairman, ANAROCK Property Consultants said, “A buyer should have checked out at least 10 properties before the search can even begin to be comprehensive. Impulse buying can happen if one has insufficient resistance to sales pitches, or if one is wooed by freebies which have nothing to do with the value of a property. Often, an unethical broker guided purely by commission will be instrumental in one buying an inappropriate property.”

4. Not doing one’s homework and due diligence

A good property purchase is always the result of adequate personal research on several different variables. Apart from the obvious ones of price and location, the buyer should also factor in how much space he or she will need further down the line, whether the infrastructure of the area will improve, whether the property is under litigation or otherwise legally problematic, and who the seller is. “When it comes to developers, sticking with reputed names is a major way of de-risking the proposition. Likewise, a buyer should check out the neighbourhood infrastructure and decide if it is adequate for the family’s needs, what the price trends have been over the last 5 years, and if all necessary facilities are available nearby,” Kumar said.

5. Not comparing with other forms of investment

Purely as an investment, it’s much easier and far cheaper to invest in financial instruments such as mutual funds, small savings, or equity. The costs of and barriers to financial investing are negligible. Unlike real estate where you’ll need to pay maintenance costs and property tax, there are no costs of maintaining your investments barring minor charges such as demat annual fees, brokerage, expense ratio in case of mutual funds etc. It’s also much easier to get out of financial investments. Financial investments can be part-liquidated when you need liquidity. But you cannot part-liquidate a property.

(Source: Economic Times)