Leading realty firm Godrej Properties is well placed to maintain its growth momentum this fiscal despite headwinds due to the Covid-19 pandemic, and will look to increase market share as well as add projects available at a distressed valuation, a top company official said.

In his message to the company’s shareholders in the annual report, Godrej Properties Executive Chairman Pirojsha Godrej said the housing demand will certainly be impacted due to the economic slowdown caused by the pandemic.

However, he said the demand from prospective homebuyers will further consolidate towards large organised developers with better track record in execution.

Moreover, Godrej said the affordability has increased due to low interest rates and stable prices over the past seven years. Home ownership would also gain currency due to lockdown.

Godrej Properties achieved a sales booking of Rs 5,915 crore during the last fiscal, the highest by any listed real estate developer.

“While we are pleased with the year gone by, it is clear that the current year will bring new challenges and opportunities. Resilience and agility will be critical to ensure that we emerge stronger from this crisis,” said Pirojsha.

The economic growth is likely to be in negative during the current financial year and the Covid-19 crisis is leading to significant amounts of job cuts and salary reduction, he said adding that this would certainly impact demand for high-value purchases such as housing.

“Despite these headwinds, we believe we are well placed to maintain our growth momentum in the current financial year… We are prepared to withstand a possible downturn in the sector — however bad it gets,” said Pirojsha.

The Godrej Properties chairman said the company would focus on capturing opportunities that might arise as a result of this crisis.

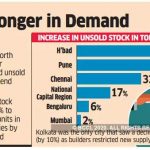

“The most important opportunity will be to gain market share. Our strong business development over the past few years has ensured that our launch pipeline is the best it has ever been. We will be agile and ready to launch these projects and thereby gain share while most of our peers are focused on liquidating their current inventory,” he said.

The new launches of projects would drive cash flows and earnings growth over the medium term.

“We will be open to the opportunity to further strengthen our portfolio if projects become available at distressed valuations,” said Pirojsha.

He said the company remains committed to medium-term goals — to consistently be among the leading developers by value of residential real estate sales in core markets, and to consistently deliver a return on equity (ROE) in excess of 20 per cent.

“Despite continued disruptions the real estate sector has faced including the current pandemic, we believe we are on track to achieve these goals,” Pirojsha said.

The company’s sales bookings in 2019-20 grew 11 per cent to Rs 5,915 crore, and resulted from the sale of 7,415 homes with a total area of 8.8 million sq ft. This averages to over 20 homes per day.

“We sold more than 1.1 million sq ft with a booking value of over Rs 1,000 crore in each of our four focus markets of MMR (Mumbai Metropolitan Region), Pune, NCR and Bengaluru,” Pirojsha said.

On execution of projects, he said the company’s strategy to shift from labour-intensive forms of construction to precast construction would help reduce project-completion timelines.

This will also reduce the gap between operating results and reported accounts, enhance project returns, and enable faster turnaround of capital.

“Our balance sheet is strong with net debt to equity at the end of Q4 FY20 standing at 0.24 to 1. Our equity raise of Rs 2,100 crore in Q1 FY20 has ensured that we have a significant surplus liquidity to withstand any temporary liquidity and demand shocks that may arise,” Pirojsha said.

Godrej Properties, the real estate arm of the Godrej group, posted a net profit of Rs 267.21 crore over a total revenue of Rs 2,914.59 crore during the last financial year.

(Source: Hindustan Times)